Success in family transfer

Success in family transfer

Transferring businesses

Making the family transfer a success

Some tips to prevent a family business transfer from going wrong.

When it is time to find a successor for the business, a family solution is the most popular. This option makes the parents proud and reassures all parties involved and offers long-term prospects and continuity.

However, there are some pitfalls to avoid in family succession:

- Fairness. When there are several children, how can the one taking over be helped without disadvantaging the others? How can one ensure that this transfer does not cause family tensions?

- Freedom. Does the buyer have the character to take on this heavy burden? Is it really his choice and is it well thought through? How can we give him enough leeway and still support him?

- Financial security. Does the choice to pass on the business in a family context enable the parents to face the future with confidence? Do they need an income or capital to secure their retirement?

These pitfalls are all the more relevant when family assets have been invested in the business, which is often the case. The desire to respect some form of family fairness then clashes with the desire to help the buyer.

Here are some tips to solve this complex equation:

- Don’t give your business away, but sell it. Transferring the business can be done by gift or sale. The very favourable tax regime (*) for gifts of family businesses leads some to consider only this option. However, selling the company’s shares is also untaxed. A donation requires certain conditions to be met (preservation of employment…). Moreover, the gift creates an asset imbalance that is difficult to offset when there are several children. Finally, the lack of financial compensation may be an obstacle when the parents need it.

- Make a transaction under normal market conditions. If the transfer is done at a normal price, with a valuation to back it up, there is less chance of tension in the family.

- Be flexible with the repayment. Deferred payment of part of the price – known as seller credit – is an excellent way to help the buyer without unbalancing the family. Periodic repayments should be carefully aligned with the company’s free cash flow.

- Respect the principle of simultaneous gifting to the children. When the parents receive the transfer price, they can gift all or part of it to their children. If this is done simultaneously with the sale (at closing), this amount can be used as the acquisition partner’s own effort.

- Consider the inheritance agreement. This instrument allows to obtain the final agreement of the heirs on the distribution of assets during the parents’ lifetime.

- Call on a conveyancing expert. He or she can value the business, suggest a financial construction, help obtain financing and draft transfer agreements. If the expert is recognised, his fees can be subsidised (**).

The sale, combined with a donation of part of the price to the children and/or a deferred payment, makes it possible to respect the family balance while helping the buyer. As every situation is different, it is advisable to carefully study the different options and their fiscal and patrimonial impact, in order to draw up the most suitable succession plan, which will offer the best guarantees of family understanding.

Tanguy della Faille

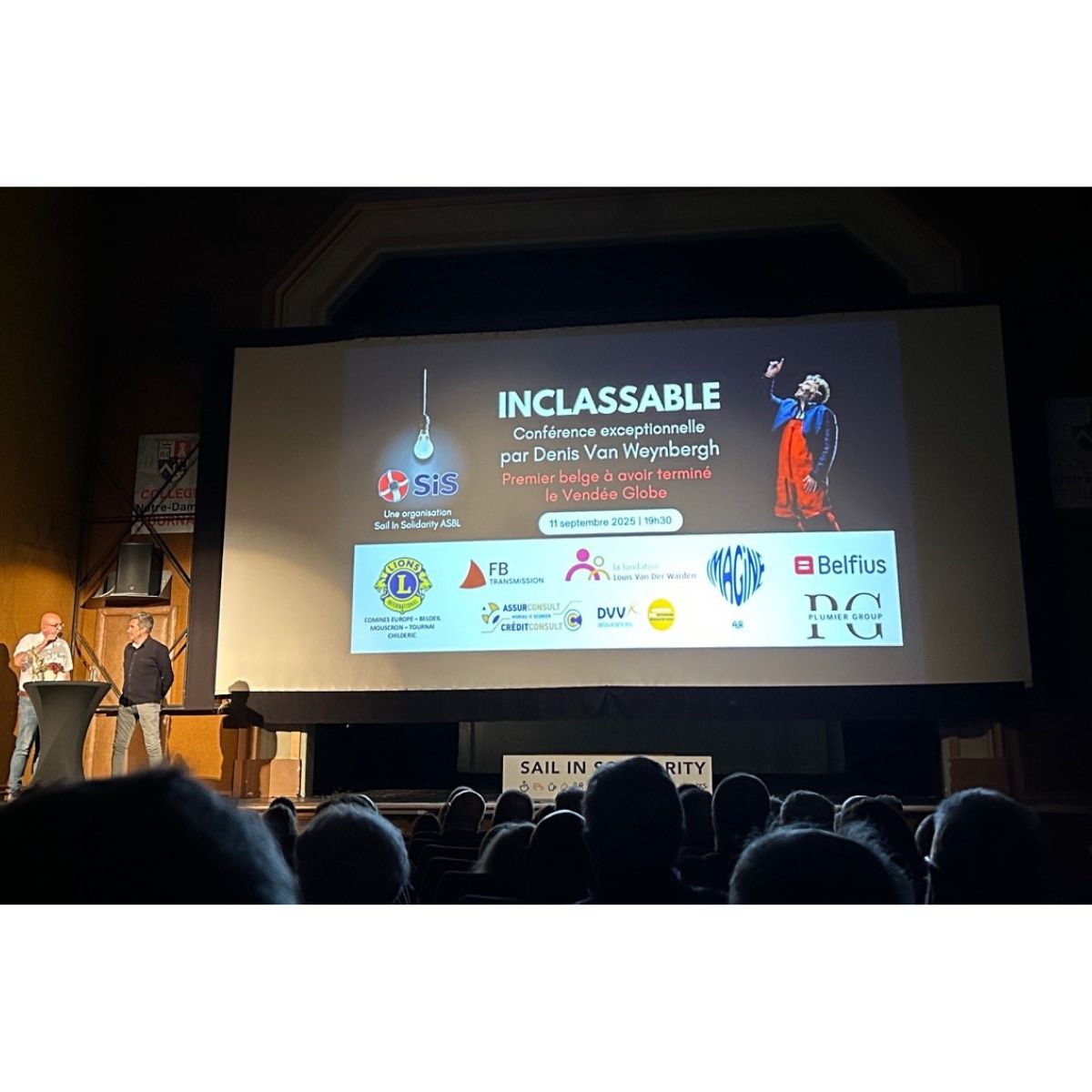

FB Transmission

tanguy.della.faille@fb-transmission.com

(*) 0% subject to compliance with certain conditions, which however differ depending on the region in which the company is located. More information at https://www.notaire.be/donations/comment-donner/donation-dentreprise

(**) This aid scheme is regionalised. In Wallonia, 75% of fees can be subsidised through the Chèques Entreprises.