How does ‘deleveraging’, the mechanism that facilitates takeovers, work?

How does ‘deleveraging’, the mechanism that facilitates takeovers, work?

This technique facilitates lending but must be applied with caution.

The term “debt push down” refers to any type of arrangement where part of the acquisition debt is pushed down to the company being acquired (the target company). These arrangements, which require a number of successive transactions, are quite complex but are nevertheless valued because they have the advantage of facilitating the financing of the acquisition.

It is in the common interest of the banker, the buyer and the seller to find a win-win formula and complete the financing as soon as possible (1).

Why deleveraging?

Given the acquiring company (holding company) usually has little substance, banks prefer to have the target company as a debtor because it has a track record, potential collateral and better creditworthiness. So it is very tempting for the holding company to use the strengths of its new subsidiary to finance an acquisition..

Which structure should be chosen?

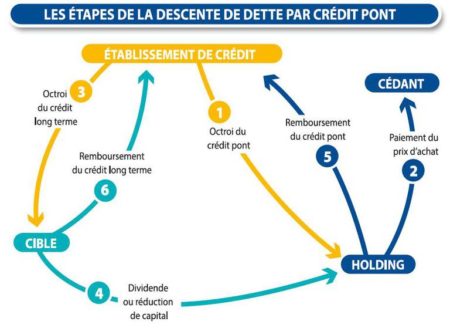

Typically, funds are provided through two loans (see figure below). A bridge loan is provided to the holding company to cover the acquisition price. After the acquisition, the bank provides a second loan to the target company itself so that it can take out a guarantee. With the available funds, the target company pays a dividend (or reduces its capital) so that the holding company can repay the bridge loan.

The final result is that the long-term funding flows back to the target company, which then repays it to the bank.

Alternative structures

Among the many variants of this arrangement, there is another common one, based on the principle of deferred payment. The holding company buys the shares of the target company in exchange for a commitment to pay at a later date (vendor loan). After the acquisition, the bank provides a loan to the target company, secured by guarantees on its assets. The target company distributes the funds raised via an exceptional dividend to the holding company, which can then settle its vendor loan. This type of arrangement is particularly suitable when there is a climate of trust between the parties (e.g. a family sale).

Sufficient equity?

Whichever arrangement is chosen, the target company must have sufficient equity. To repay the bridge loan or vendor loan, the target company will have to pay a dividend, which is only allowed to the value of the available reserves (including retained earnings). If the share capital is large, a capital reduction can also be considered.

Financial assistance or not?

Does debt reduction fall under financial assistance or not? This question is often asked. As a reminder, when a target company assists its parent company to acquire its own shares, financial assistance consists of setting up a special procedure, subject to strict formalities, to protect the interests of creditors and minority shareholders. Nowadays, it is accepted that incurring debts does not necessarily imply the implementation of financial assistance, as causality is an essential distinguishing feature (2).

Case-by-case analysis

The proposed regime must therefore be analysed on a case-by-case basis. The documentation of the transaction is important, because if the link between the bridging loan and the long-term loan can be established at the start of the scheme, it will be difficult to deny causation. On the other hand, if the two transactions are not intentionally linked, the financial assistance formalities do not seem necessary.

These legal provisions should be interpreted restrictively. Doubt therefore favours the litigant. However, it is advisable to use this type of arrangement with caution and seek specialised advice.

(1) This article is freely inspired by the work of Koen Troch, André-Pierre André-Dumont and Xavier della Faille.

(2) This principle was established in a judgment of the Mons Court of Appeal of 16 April 2012.

Photo : Shutterstock